Ted Thomas has been showing, guiding, and nurturing student investors through the process of how to invest in tax lien certificates for over 25 years. Today Ted Thomas is known as America’s Tax Lien Certificate and Tax Deed Authority. In the video linked below Ted discusses the list of tax lien certificate states and some investment advantages of investing in tax lien certificates.

| Type: | Tax Lien Certificate |

| Bidding Process: | Premium |

| Frequency: | Annually In Apr-May-Jun |

| Interest Rate / Penalty: | 12% |

| Redemption Period: | 3 Years |

| Online Auction: | No |

| Over the Counter: | Yes |

| Statute: | Code of Alabama 1975, Sec 40, Ch 10 |

Alabama is a tax lien certificate state. With 67 counties, you have plenty of sales to choose from. Sales are held from April-June each year. The interest rate is fixed at 12 percent. The winning bid is whoever pays the most for the property. You only earn interest on the property taxes. You do not earn interest on your overbid.

The owner has three years to redeem the property. If the property is not redeemed in that time, you take the lien certificate to the tax office and swap it for a tax deed. When you pay taxes as they come due, you also earn interest on them.The state Department of Revenue handles any unsold properties. To buy these, you need to know the parcel number for the property.

Click HERE for the complete list of rules. To learn more about the rules, plus the tips and tricks of tax lien investing, take this Free Course from the leading authority on the subject.

| Type: | Tax Lien Certificate |

| Bidding Process: | Bid Down the Interest Rate |

| Frequency: | Annually in February |

| Interest Rate / Penalty: | 16% |

| Redemption Period: | 3 Years |

| Online Auction: | Yes – Not All Counties. Various Sites. Largest County Is Maricopa County |

| Over the Counter: | Yes – Liens Only |

| Statute: | Arizona Statute Title 42, Ch 18, Art 3 |

In Arizona, you buy tax liens by bidding down the interest you will accept. The interest rate starts at 16%. Sales are held in February. The property owner has three years to redeem the lien. If the lien is not redeemed, you go to court and foreclose on the property.

To buy a lien, you must fill out a bidder information card and complete an IRS form W-9. How you pay for a winning bid depends on that county’s tax collector. If you plan a wire transfer, you need to set this up with the tax collector before the sale. When additional taxes come due, pay them off. You earn interest on these at the same rate you bid in the auction.

If a property does not sell, a tax deed sale may be held. Contact the tax office in the county where the property is located for information about this sale. For even more information, take this free mini course from the leading authority on tax lien certificates.

| Type: | Tax Lien Certificate |

| Bidding Process: | Premium |

| Frequency: | Annually in Fall |

| Interest Rate / Penalty: | 9 Points Above Federal Discount Rate (Prime) |

| Redemption Period: | 3 Years |

| Online Auction: | Yes |

| Over the Counter: | Yes |

| Statute: | Colorado Revised Statutes 39-1-102 |

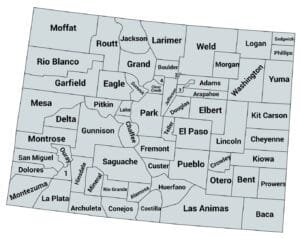

Colorado sells tax liens. The interest rate is 9% over the prime rate so it varies. The highest bidder gets the lien. Colorado lets people bid more than the amount of past-due taxes. Be aware you do not earn interest on this overpay nor do you get it back. The tax office keeps any amount you spend over the opening bid price. The bidding process is different in each county so check with the tax office before the sale.

Some Colorado counties have in-person auctions and some have online sales. You need to register for the sale and send in a completed IRS form W-9.

The owner has three years to redeem the deed. During that time, you need to pay taxes as they come due. You earn interest on those taxes as well. After three years, you can exchange the lien for a treasurer’s deed at the tax collector’s office.

For a complete training on tax lien investing, you’ve come to the right place. You can get started today at no cost with this free mini class from Ted Thomas, America’s leading authority on tax lien certificates and tax defaulted property.

| Type: | Hybrid – Liens & Redeemable Deeds |

| Bidding Process: | Premium |

| Frequency: | Annually – Varies Throughout Year |

| Interest Rate / Penalty: | N/A |

| Redemption Period: | 1 Year With 18% Penalty |

| Online Auction: | No |

| Over the Counter: | No |

| Statute: | Connecticut Gen Stat Title 12 Ch 204 |

A lot of people look at tax deed states’ auctions and see undeveloped land. They give it a hard pass. Sometimes, that may be the right thing to do. Sometimes, that might NOT be the right thing to do.

In Hartford, the City Council put an eye on several undeveloped tracts on the north edge of downtown. City officials reasoned if the City bought the property at the auction, they could use it for development. Hartford already owned some nearby parcels.

If the City has genuine development plans for the area and can make it happen, property values in the area will go up. Investors and businesses will move in. This is an example of buying property in a tax sale and then selling it later, at a profit, to someone who wants to develop it.

A purchase here should take a lot more research than usual. You need to know the City’s plans in detail. That will tell you if the property is worth buying. Ted Thomas can show you how to do the research, vet properties, buy and quickly sell them. Take advantage of this free class today.

| Type: | Hybrid – Both |

| Bidding Process: | Liens – Bid Down the Interest Rate. Deed – Premium |

| Frequency: | Throughout the Year Per County Discretion |

| Interest Rate / Penalty: | 18% |

| Redemption Period: | 2 Years |

| Online Auction: | Yes |

| Over the Counter: | Yes |

| Statute: | Florida Statutes Chapter 197 |

The Balance, an online magazine for investors, said if you do it right, Florida is a great state for tax lien investing. “For example, Florida’s maximum interest rate is set at 18% while Arizona’s maximum rate tops out at 16%. Either one could help you earn more than you might in a fund that tracks an index like the S&P 500, depending on the condition of the stock market.”

What The Balance is not telling you is the stock market has averaged 5.6 percent over the last 20 years, says the investing information website SoFi. SoFi adds, “In early 2000, the market was doing exceptionally well, but from late 2000 to 2002, the dot-com bust contributed to losses for three consecutive years. That period wasn’t helped from the aftermath of 9/11 in 2001. In 2008, the financial crisis led to huge losses.”

Compare the stock market to an investment backed by state law, federal law and several Supreme Court decisions. Investing in tax lien states is safer than the stock market and delivers solid returns. Ted Thomas is based in Florida. Not only is he America’s leading authority on tax lien certificates, but he also knows Florida like the back of his hand. Take advantage of Ted’s expertise with this free course.

| Type: | Tax Lien Certificate |

| Bidding Process: | Bid Down the Interest Rate |

| Frequency: | Annually – Varies Throughout Year |

| Interest Rate / Penalty: | 36% |

| Redemption Period: | 2 to 2 1/2 Years Depending on Classification of Property |

| Online Auction: | No |

| Over the Counter: | |

| Statute: | 35 ILCS 200/21 |

CNBC looked at investing in tax lien states. The report studied Illinois and discovered it makes sense to have some tax liens in a portfolio of investments. The report starts with Bennie Smith, an ordinary man looking for a way to build some cash fast. He bought two properties in his town. The vacant lot was redeemed in less than a month and he pocketed a $100 profit, an excellent profit on a $600 investment. The other property he spent $5,000 on and wound up owning the home.

The key to making a big profit quickly is to buy property that has a high chance of being redeemed. DS News, a website for the mortgage industry, says, “Redemption investors are more interested in obtaining a conservative, high-yield return upon the redemption/payment of their tax liens. That means focusing on states where the redemption periods are longer/less aggressive yet provide a high annual compounding yield, such as Illinois (36 months, 36 percent) or Iowa (24 months, 24 percent).” Learn from the foremost expert how you can earn high rates of return secured by real estate, like Bennie Smith did, and take this free class today.

| Type: | Tax Lien Certificate |

| Bidding Process: | “Overbid” (Premium) |

| Frequency: | Annually Sometime in the Fall |

| Interest Rate / Penalty: | 10% Penalty if Redeemed in 1st 6 Months, 15% Penalty if Redeemed in Months 6-12, but Only on the Taxes and Fees Not the Overbid. Overbid Amount Receives 5% Interest. |

| Redemption Period: | 1 Year if Sold at County Sale, Liens Not Sold at County Sale Are Certified to Commissioner and Sold in “Commissioner’s Certificate Sale” With 120 Day Redemption Period |

| Online Auction: | Yes |

| Over the Counter: | No but There Is a Second Auction Called a Commissioners Certificate Auction With a Shorter Redemption Period of 120 Days |

| Statute: | Indiana Code 6-1.1-25 |

Investing in tax lien states can happen across the country or next door to you. Noble County, IN, held a tax sale in the summer of 2020. One of the properties on the auction block was 2581 S. Lakeside Drive, Albion, a lot on Small High Lake. The past-due taxes were $15,632.89. That was more than a year of past-due taxes. A check at the real estate website Zillow shows the tax debt should run under $300 a year.

Again, checking with Zillow, the property now has a house there. The Zillow estimated price is $21,000 and the website says the owner can expect to earn $675 a month in rent. That comes out to $8,100 per year. Figuring in taxes and other associated costs, even if you had to borrow the $15,632 to buy it, you would pay off the loan in under three years. With the loan paid off, you could then continue to rent the property and keep most of that $675 you earned every month. That’s a big profit. To learn how to make big profits from tax lien investing, take advantage of this free mini class.

| Type: | Tax Lien Certificate |

| Bidding Process: | Random Selection Process in Lieu of Bid Down Ownership Interest |

| Frequency: | Annually 3rd Monday of June |

| Interest Rate / Penalty: | 24% |

| Redemption Period: | 2 Years |

| Online Auction: | No |

| Over the Counter: | No |

| Statute: | Iowa Code Chapter 446 |

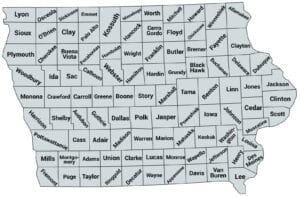

A lot of people think they can only buy tax lien certificates for houses when investing in tax lien states. Not so. An article in Des Moines Register newspaper points that out. Writing in 2020, just as the Corona virus pandemic was beginning, the newspaper looked at tax sales in Polk County, The article also noted tax sales were unlikely in 2020 because of the pandemic. The report by Lee Rood found 5,000 properties across the county had past-due taxes. They included.

Merle May Mall – owing $588,239

Ramada Inn – owing $239,977

Campus Town Apartments – owing $139,897

While some investors cannot afford to drop nearly $600,000 on a tax lien certificate, Polk County had plenty more opportunities to invest for far less. These included more commercial properties, plenty of homes and some undeveloped land. Prices in the eventual auction started in the thousands and went up from there. You can take advantage of an opportunity today. Ted Thomas, the leading expert on tax liens, is offering you a free course.

| Type: | Tax Lien Certificate |

| Bidding Process: | Sealed Bid First Come First Serve Basis but Must Be Present |

| Frequency: | Annually – Varies Throughout Year |

| Interest Rate / Penalty: | 12% |

| Redemption Period: | 1 Year |

| Online Auction: | No |

| Over the Counter: | No |

| Statute: | Kentucky Rev Statute Ch 134 Art 420 |

Taylor County, county seat Campbellsville, keeps a running list of properties with past due taxes dating back to 2005. A recent check of the web page with the past-due properties shows most amounts were under $1,000. The biggest past due amount was $6,452.69. When we wrote this, the list was updated that day, so we don’t know which of these properties are headed to auction and which will be paid. Regardless, if you want to invest in tax lien states, Kentucky offers the chance to make big profits.

Just as an exercise to see if a property is worth investing in, we looked at some properties. Here are some random selections.

223 Risen Ave., Campbellsville. This is likely to hit the auction block because it has past due taxes dating back to 2011. The total taxes owed are under $2,000. Checking on the real estate information website Zillow, we learn the 1,602 square foot home has an estimated value of $40,000. If you get the property through a tax lien foreclosure, you could expect $975 a month in rent.

115 Eggers Street, Campbellsville. Taxes on this house date back to 2010 and total a bit more than $600. This is a mobile home and has an assessed value of $10,000. Zillow warns it does not have all the facts about the property. The current pictures show a single-wide in rough shape. Unless you can get someone in Campbellsville to personally check this one out, best to avoid it.

116 Baptist St, Campbellsville. Something important to note here. The taxes have eased up every year since 2013. That is not the case for all the properties in the list. More importantly, what does Zillow have to say about the 1 BR, 2 BA home? Zillow says it is worth $34,693. Zillow warns the house needs some work, which is obvious from the pictures. Another house you need more information about before investing.

Just because a house needs work does not mean it is a bad investment. You are buying the lien, not the property. If the owner lives there, he will redeem it more than 95% of the time. Ted Thomas, the foremost authority on tax lien certificates and tax defaulted property investing, can teach you how to narrow down a list of properties to find the best deals and sell your bargain real estate purchases quickly for big profits. Start your education today with this free mini course.