Dan Buckley is an US-based trader, consultant, and part-time writer with a background in macroeconomics and mathematical finance. He trades and writes about a variety of asset classes, including equities, fixed income, commodities, currencies, and interest rates. As a writer, his goal is to explain trading and finance concepts in levels of detail that could appeal to a range of audiences, from novice traders to those with more experienced backgrounds.

Oct 26, 2023In this article, we cover all things related to the forward markets and forward contracts.

A forward contract – often simply called a forward – is a contract between two entities to buy or sell an asset at a time and price specified in the contract.

This makes a forward contract a type of derivative, like options and swaps.

It is traded over-the-counter (OTC) and typically off-exchange.

Namely, forwards trading is normally conducted directly between two parties, without the supervision of an exchange.

A forward looks almost exactly like a future except for one main difference: it’s privately negotiated between two parties rather than standardized by an exchange.

A forward contract also differs from a futures contract in that delivery never necessarily takes place.

In the case of futures, traders will normally close out such positions ahead of their expiration to prevent delivery, especially in cases where delivery of the underlying asset is impossible (e.g., cattle, corn, etc.).

At this point in time, forwards and futures may also differ because forwards have no daily marking-to-market or variation margin requirements like futures contracts do.

Moreover, forwards differ from futures in so far as forwards are technically not standardized and therefore have little liquidity.

They are typically one-off agreements directly between two different parties or intermediated by a bank.

For futures markets, everybody is buying or selling the same instrument.

A forwards contract is not a forwards market in the sense that a forwards market consists of many individual forwards contracts.

Also, derivatives markets, in general, may talk about the forward market to refer to an organized futures exchange or trading platform, whereas forwards are traded on OTC markets.

If you’re looking to speculate on the price movements in an asset, forwards aren’t a good choice because they don’t always provide adequate liquidity (i.e., it’s not easy to trade in and out of them). They may also not provide adequate leverage or the ability to get certain exposures (e.g., shorting a market).

Because forwards carry credit risk (i.e., the bank could technically renege on its promise or fail) in addition to the standard market risks, they aren’t used in many cases where standardized futures contracts are available.

For example, if one wanted to take larger leveraged positions on the S&P 500 or WTI crude oil, it will typically make more sense to get that exposure through the futures market through the ES and CL contracts offered by Globex and NYMEX.

Forwards might also not allow some traders who need very large positions to trade forwards.

Today, there are two types of forwards markets – OTC and exchange-traded forwards contracts. The forward prices on exchanges tend to be more volatile than swaps because of liquidity-related matters.

Forwards traded OTC may not reflect the market as a whole.

Forwards are commonly used by companies to hedge their exposure on foreign currencies or commodities prices.

The forward markets will likely continue growing because forwards may allow for more risk to be taken on – due to their customized nature – than futures contracts, and can provide substantial benefit over just trading individual bonds, stocks, or individual assets.

As forwards contracts tend to be one-off agreements with no daily marking-to-market or margin requirements, they may cost significantly less than buying and selling derivatives on exchanges like CME and ICE which require these margining costs.

This can allow those transactions in forwards to conserve cash that they can employ for other uses.

Companies also find it helpful to use forwards for hedging purposes or limiting exposure to risk factors through cash flow matching strategies.

A forwards contract is a customized agreement between two parties to buy or sell an asset at a determined price at an agreed-upon date in the future.

This is typically done outside of any formal organized futures exchange, though forwards contracts are sometimes traded on exchanges alongside futures.

The forward contract entails an obligation (to deliver) for both the buyer and the seller, whereas simple options do not entail such an obligation (i.e., the right but not the obligation).

Forwards provide more risk management opportunities than futures because they allow for more flexibility – forwards may be written on nearly anything. It’s up to buyers and sellers to determine what they want to trade (and how they want to structure their agreement).

Forwards must be very carefully analyzed by brokers offering them given there can be substantial risk involved.

How forwards exchange-traded forwards and OTC forwards work:

For forwards, the underlying asset is always traded on another market, such as equities or currencies.

And those markets determine its price for forwards contracts.

The two parties then agree on a set price at which they will trade that specific amount of assets in the future – agreed upon by both parties at a specific time. This means there’s no daily marking to market like with futures.

Forwards can be used as a tool to hedge against or lock in future cash flows, much like forwards are used today.

Unlike futures that are bought and sold on exchanges, OTC forwards typically aren’t standardized contracts.

And when forwards contracts are traded OTC, not all details about them may be disclosed publicly by brokers offering them, so it’s important to always analyze carefully before getting involved in one.

Spot–forward parity is the relationship between the price of a forwards contract and its underlying asset’s spot price.

Generally, if the forward price of an asset equals the spot price, then there is no potential arbitrage opportunity for that particular instant in time – though this can differ depending on how forwards and futures contracts are priced using interest rates and dividends.

While forwards prices typically track fairly closely with spot prices, deviations do occur sometimes.

Deviations may be due to added costs such as transportation or storage costs. There may also be some level of seasonality involved, like with natural gas or lean hogs. Because these things matter so heavily to the price, it’s important to analyze carefully when dealing in forwards.

It’s important to remember that forwards aren’t always traded OTC so it’s never safe to assume forwards will follow their spot counterparts.

And forwards can provide substantial benefits over other types of derivatives.

Spot–forward parity is important to understand when investing in forwards so it’s never safe to assume forwards will follow spot prices.

The market’s perspective about what the prevailing price of an asset is (i.e., the spot price) is closely related to the expected future spot price.

So the main concern is whether the current forward price does a good job of predicting the respective spot price in the future.

We can see this in any market.

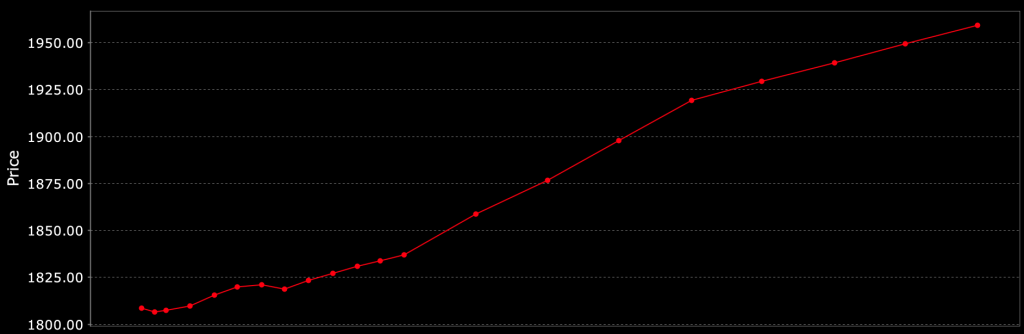

For example, in the interest rates markets, the future path of interest rates is shown by the yield curve.

The two-year bond rate notes the expectation for where interest rates will be in two years’ time.

We can also look at the fed funds futures market to determine the market’s expectation for where interest rates will be going forward.

This is of concern for not just rates traders, but also equities traders and others because of the impact interest rates have on stocks and all other financial assets.

Expanding on the last point, the concept of the forward curve is important in all asset markets.

Adding alpha to a market involves looking at what’s baked into markets and deviating from that in some way.

Traders and investors often talk about what’s already discounted into the price of a market.

In the rates market, what forwards markets are trying to capture is the future path of interest rates.

The forward curve tells us the current market’s expectation for where interest rates will be in the future.

While forwards markets can tell you where traders expect rates to go, there is no guarantee that they’re right.

They often differ materially relative to expectations, which is naturally where a lot of the big profitable trade opportunities can be – and potential big losses, if not properly hedged against them.

Just like having a sense of what stocks or any asset may do in the future doesn’t mean you have any advantage over other traders. If everyone knows something, it’s already priced into markets.

A good example of this was US Treasuries back in the early-2010s when traders were expecting rising rates from their existing very low levels.

But because of the big debt overhang associated with the financial crisis, it was too premature for the economy to handle higher rates.

So the discounting of higher rates never transpired, which was a win for those who were broadly long interest rate futures, when yields eventually declined relative to expectations.

Betting with the consensus is often referred to as beta returns, such as owning index funds on the stock market.

Contango is when the forward price of an asset is higher than the expected future spot price.

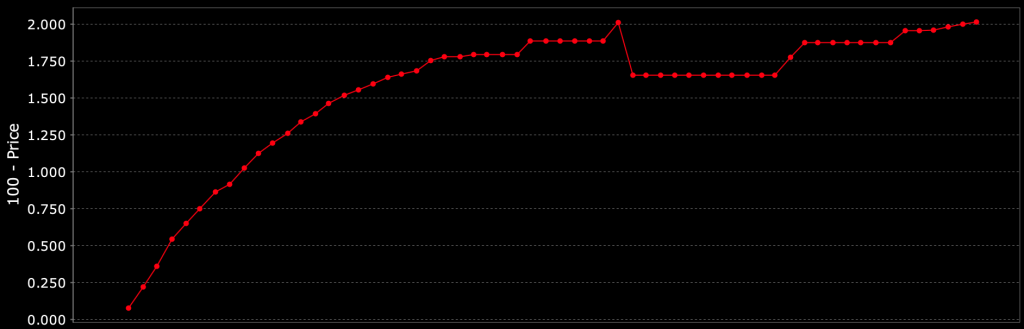

Contango can be better understood with a graph.

Gold, for example, is a structurally contango market.

You almost always see gold discounted at a higher price in the future than where it is now.

This partially reflects storage costs.

In other words, there is a cost associated with storing gold, so in the futures market (or a gold forward) this reflects in a higher price in the future relative to the spot price today.

Moreover, over time the price of gold is expected to go up because of gold’s nature as a type of inverse money.

Gold going up is a reflection of demand outstripping supply (like any other market). But it is largely driven by the value of money over the long run.

Gold isn’t intrinsically worth more over time. Gold is still just gold. It’s largely a reflection of the value of money going down.

Because central banks will always target an inflation rate of at least zero to avoid deflation, this means that “inverse money” type of commodities are expected to have a positive forward nominal return.

Over the long run, the expectation is that gold will have a real return of about zero, or roughly provide the trader the rate of inflation with respect to the reference currency.

Of course, there will be a lot of volatility along the way, so gold is not a perfect inflation hedge by any means, especially in the short and medium term.

In a contango environment, there is no arbitrage opportunity from buying the underlying asset and selling it in a distant month at a higher price.

The spot price is more volatile than the forward price (especially when going long into the future). The forward price will tend to stay more anchored.

Owning the asset at spot will also require a continuous rolling of those contracts. So there’s the risk of the spot price moving against you in addition to trading costs.

While any adverse price moves may be offset to some degree by favorable movements in the forward contracts, it’s unlikely they’ll offset fully.

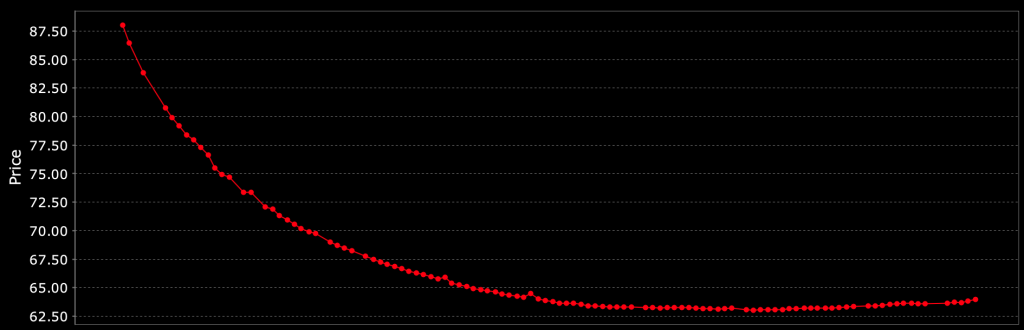

In a normal backwardation market, the forward price is less than the expected future spot price.

As a result, investors buying forwards are making a bet that the future spot price will be favorable relative to what they can lock in today.

This is an example of the WTI crude oil market where spot is at $88 but futures up to 10 years out place the price below $65.

Traders who want to sell spot and buy forwards to try to take advantage of that spread take on exposure to possible unfavorable movements in spot prices as well as trading costs.

There are many types of forward markets, like in standard financial assets (interest rates, equities, commodities, bonds) and less traditional forward markets like emission futures and emission forwards, power forwards, etc.

Currency forwards are an example of derivatives that are not traded on exchanges.

They are instead traded OTC (over-the-counter), with the counterparty taking on credit risk. (Counterparty risk refers to the risk that one party will default on their obligation and not pay out what was supposed to be paid.)

Contracts like FX forward often need to be bought in cash settlement terms rather than actual delivery of any currency specified in the agreement.

Settlement forwards like these tend to be more expensive than standard forwards because of the greater collateral requirements, among other things.

They may also require a lot more due diligence on the part of market participants since there is no central clearinghouse when something goes wrong.

A dividend future is a futures contract that pays off based on the result of a stock’s dividends.

It may be used as an alternative to collecting dividends, especially if one doesn’t own shares in the underlying, or wants to reinvest elsewhere.

In other words, it may represent a way to derive income out of a market where it might otherwise be difficult.

The price of the dividend future will be less than the price of the underlying stock because investors can earn extra return by holding onto their cash until it becomes due.

A forward rate agreement is an OTC derivative instrument where two parties agree on an interest rate for borrowing between now and some future date.

Both parties are at risk of default. The longer float time carries more credit risk because no collateral can be posted in the meantime.

These forwards are basically just contracts where the actual underlying asset is something other than a traditional commodity, index, or standard asset.

These types of forwards are custom agreements typically designed by banks or private investors.

These are transacted in to get a unique type of exposure that can’t be achieved in traditional markets.

A forward rate contract is a non-standard derivative where the underlying asset is some future interest rate.

The price on these forwards are sensitive to expectations of the shape of the yield curve. Prices on forwards along different points on the yield curve can be highly correlated.

Curve flatteners and curve steepeners could be considered types of forward rate contracts.

These forwards are essentially just an extension of plain vanilla forwards but include additional terms based on various permutations of cash flows between two parties, which may include amortization periods, caps, or other features.

These forwards are commonly used in conjunction with swap agreements, giving them more of a role in hedging against adverse volatility fluctuations.

An interest rate future is a futures contract that pays off based on the result of some interest rate.

This might be fed fund futures or based on fed funds futures (i.e., eurodollars), or another interest rate.

A rate forwards market refers to an OTC market for interest rate forwards, which are custom agreements between two parties typically designed by banks or individuals.

Perpetual forwards are forwards that do not have an expiry date.

If you expect the underlying asset to perform in a similar way over time, then forwards like these can be used as alternatives to futures contracts.

These forwards are cash settled, typically to represent some reference price for the commodity involved instead of having physical delivery.

They may be used for hedging or speculation.

The spot market is where commodities are traded for immediate delivery, rather than forwards or futures.

Prices on the spot market tend to carry more risk due to various factors such as storage costs and the demands associated with purchasing physical goods.

In many cases, the price of a forward will take into account future interest rates (even when the forward isn’t related to interest rates) because traders and investors can earn extra return by holding onto their cash and using it for different purposes.

Single-stock futures are forwards that offer equity exposure to a single stock rather than a derivative of an index or an interest rate.

If you expect the underlying asset to perform in a similar way over time, then forwards like these can be used as alternatives to futures contracts.

Slippage is the difference between the expected price of an order and what you actually pay.

In markets where there is less liquidity, slippage is more common.

Moreover, the larger the trade size, the likelier it is for there to be slippage.

For example, when selling a stock, if a trader wants to sell 100,000 shares but there are only 5,000-share bids at each $0.01 increment under the prevailing market price, the transaction may push the price of the market down by $0.20 per share by the time it’s completed.

This is part of what is collectively referred to as slippage costs, or transaction costs in general.

It’s also why some traders prefer to make trades during the most liquid parts of the trading day.

For US stocks, this might be between 9:30-10:00 AM EST and between 3:30-4:00 PM EST. Other periods tend to not have as much activity and liquidity

A hedging forward is a forwards contract specifically designed to help protect businesses (or individuals or countries) against adverse changes in currency or interest rates.

Forwards contracts are typically used for hedging purposes by large corporations that have substantial foreign exchange exposure.

Hedging forwards are not widely popular with smaller traders and investors, though they can be useful for those wanting to diversify their portfolios or hedge risk.

A stock market index future is a futures contract that pays off based on the performance of some specified equity index.

For example, an S&P 500 Index (S&P 500) future or E-Mini S&P 500 future would pay off based on the price of a group of stocks traded on the New York Stock Exchange (NYSE) or NASDAQ.

If you expect the underlying asset to perform in a similar way over time, then forwards like these can be used as alternatives to futures contracts.

They can also refer to OTC markets for forwards, which are custom agreements between two parties typically designed by banks or individual investors.

If you expect the underlying asset to perform in a similar way over time, then forwards like these can be used as alternatives to futures contracts.

A non-deliverable forward (NDF) is a forward or futures contract where two entities settle the difference between the contracted NDF price and the current spot price.

It is often used in the commodities markets as well as the foreign exchange markets.

In some countries, NDFs are common where trading in the FX forwards market has been outlawed as a way for the government to cut down on exchange rate volatility to avoid undermining their own efforts to effectively manage the currency.

In the FX space, an NDF is a forwards contract in the foreign exchange market that specifies the acceptance of one currency in settlement of a transaction, but delivery will not take place. This typically occurs when both currencies are widely used in international trade and are easily convertible into each other.

NDF contracts are typically used for hedging purposes by large corporations that have substantial foreign exchange exposure.

Non-deliverable forwards are often known as forward contracts for differences (FCDs or FCFDs).

Below is a list of currencies that trade in the NDF space:

Forwards are typically traded over the counter, meaning they are customized agreements between two parties to buy or sell an asset at a determined price at an agreed upon date in the future.

The forwards market is a way to protect traders, investors, corporations, and countries from adverse price changes.

Forwards markets refer to OTC markets for forwards. Forwards exchange-traded forwards and forwards OTC work differently but have many of the same risks involved.

Perpetual forwards are forwards that do not have an expiry date. This means that there is a possibility of early assignment and delivery while holding forwards. If you expect the underlying asset to perform in a similar way over time, then forwards like these can be used as alternatives to futures contracts.

A forwards price will equal the futures price only if the underlying asset is expected to have no risk of early assignment or delivery before expiration.